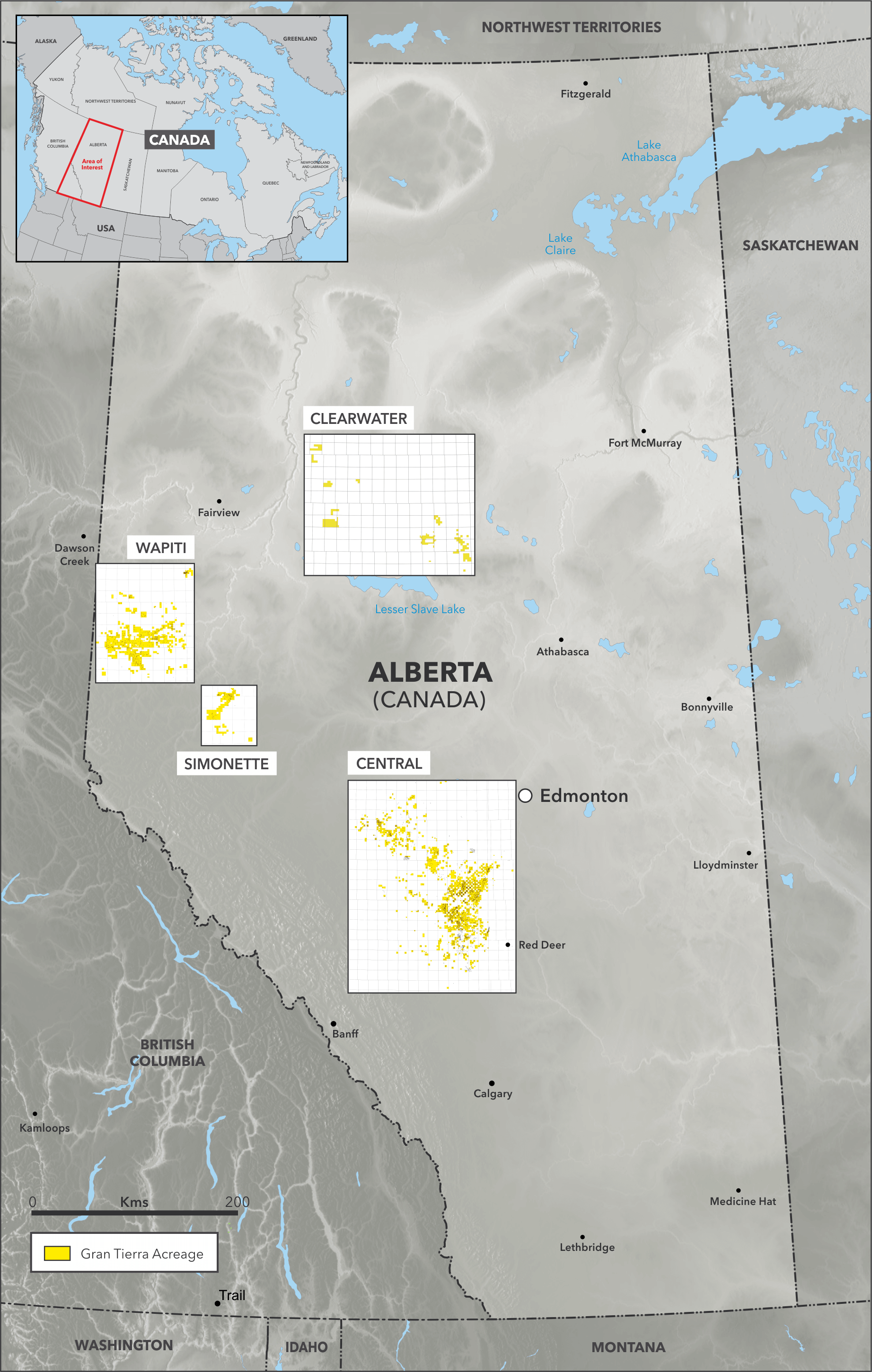

Gran Tierra Energy is a publicly listed diversified exploration and production company, with assets in Canada, Colombia, and Ecuador. Gran Tierra’s corporate strategy is to focus on proven, under-explored conventional hydrocarbon basins which have access to established infrastructure and competitive fiscal regimes. The Company’s newly acquired Canadian operations are focused on developing, and producing long-life, low-decline, high-return assets in the Western Canadian Sedimentary Basin.

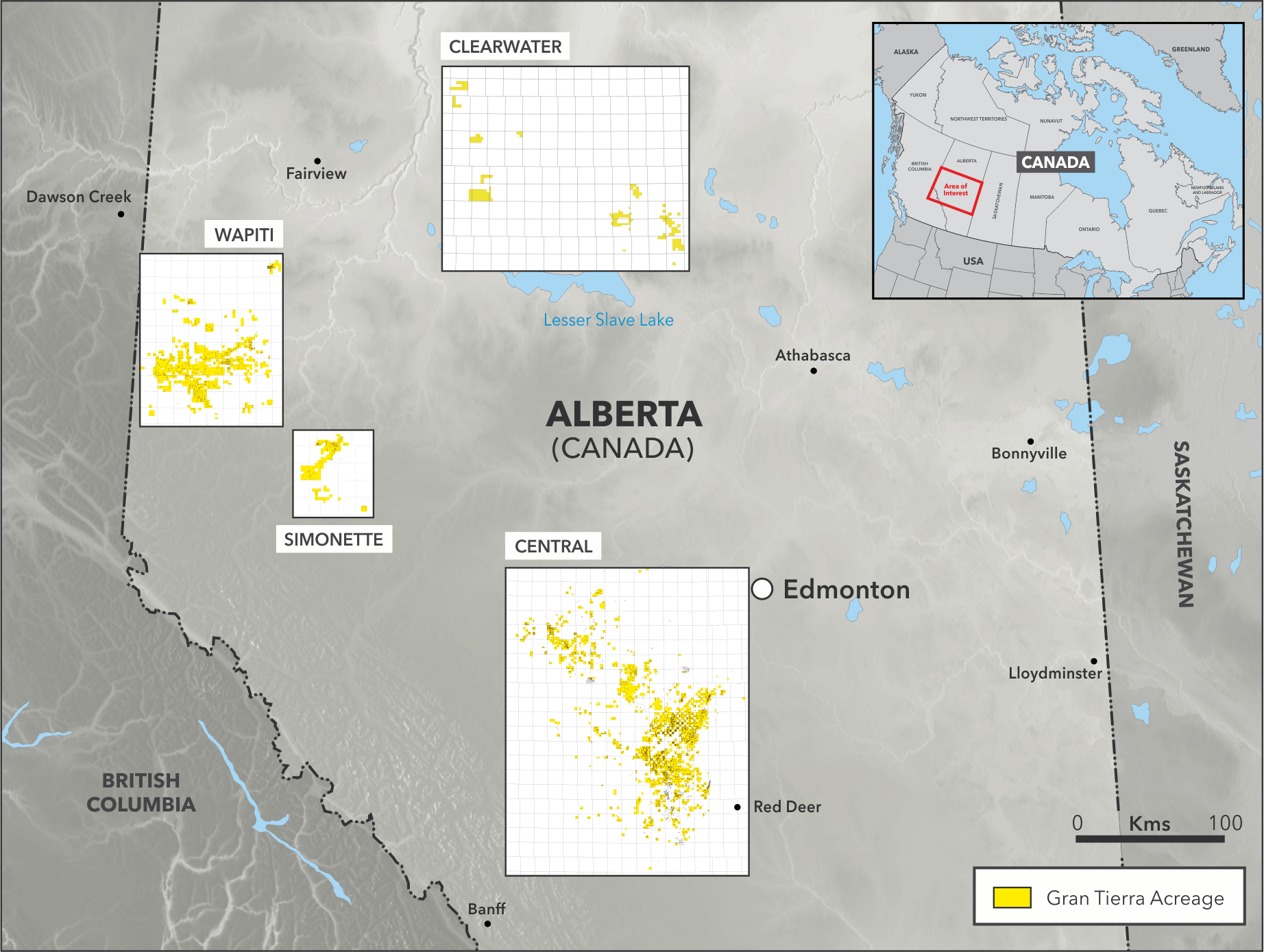

Gran Tierra’s management team has a proven track record of successfully managing large, international projects across Latin America, Africa, the Middle East, Asia and Canada. Gran Tierra has assembled a diversified, high-quality asset base which is 100% operated in Colombia and Ecuador and 63% in Canada. The Company currently operates a total of 25 blocks in Colombia and Ecuador, spanning three basins and over 1.5 million gross acres. Gran Tierra also now holds large contiguous areas in Alberta, Canada, spanning 1.2 million gross acres across the Western Canadian Sedimentary Basin. Gran Tierra has 293 million barrels of oil equivalent of proved plus probable reserves which is based on Q4 2024 actual production of 46,619 barrels of oil equivalent per day and translates to almost 17 years of reserve life.

The Company’s mandate is to grow cash flow from existing assets and reserves that exhibit long-term, low decline rates through production, development and enhanced oil recovery techniques. With the addition of Canada, Gran Tierra is well-positioned for long-term commodity cycles with approximately 20% of its production now attributed to natural gas. Additionally, Gran Tierra allocates a percentage of free cash flow to its extensive exploration resource base.

Corporate Presentation

Building Scale and Diversification

Creating runway for profitable growth and optimum capital allocation.

Gran Tierra Uniquely Positioned for Value Creation

- Sustainable business model with significant value in booked reserves base

1P reserves underpin value; clear path to 2P and 3P exploitation; world class hydrocarbon basins

- Disciplined financial strategy; prudent discretionary capital programs

Focused on debt reduction, long-term value creation

- World class development and low risk exploration in five proven onshore basins in Canada, Colombia, & Ecuador

Extensive seismic and well data across expansive acreage position

- Diversified booked and unbooked development drilling opportunities that support ongoing growth across the portfolio

- High impact near-field exploration program in both Ecuador and Colombia with active drilling in the Clearwater and Montney plays in Canada

- Going Beyond Compliance

Meaningful and sustainable impact within the communities where we operate, with a continued focus on reducing emissions

Click symbol to view GTE’s current blocks

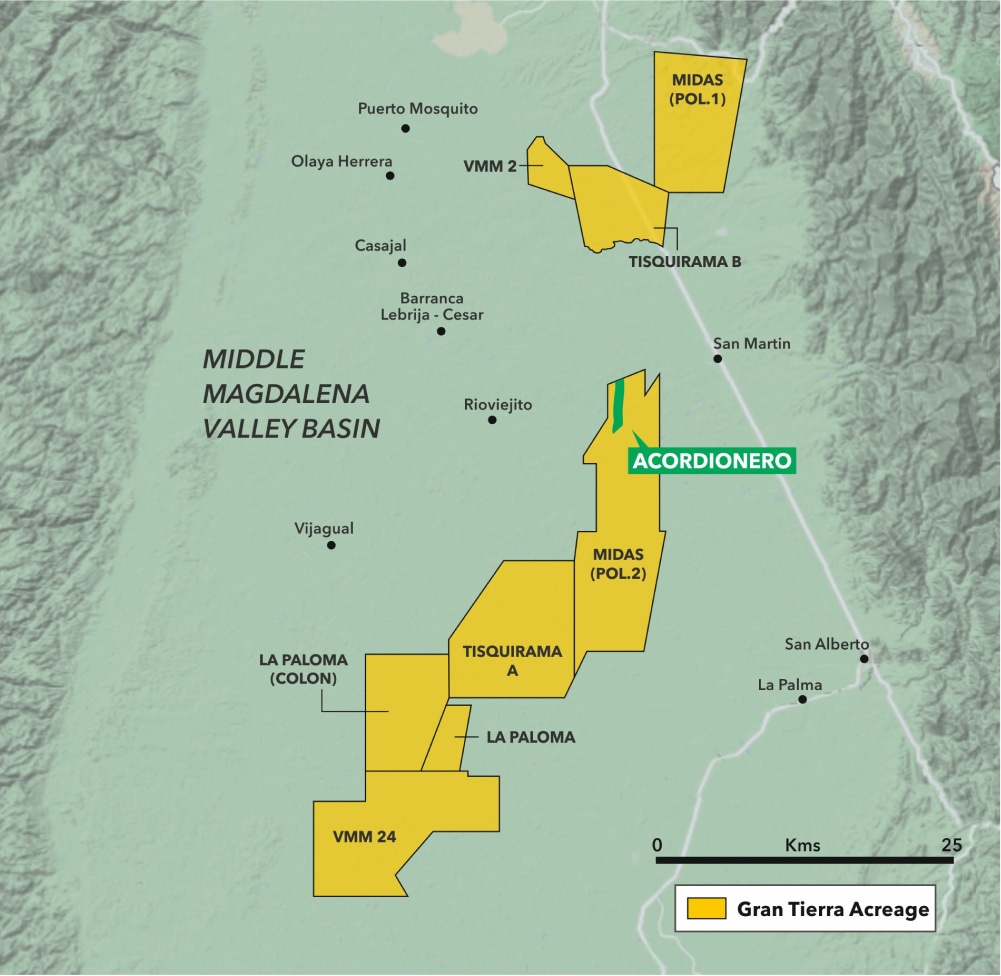

Middle Magdalena Valley Acreage

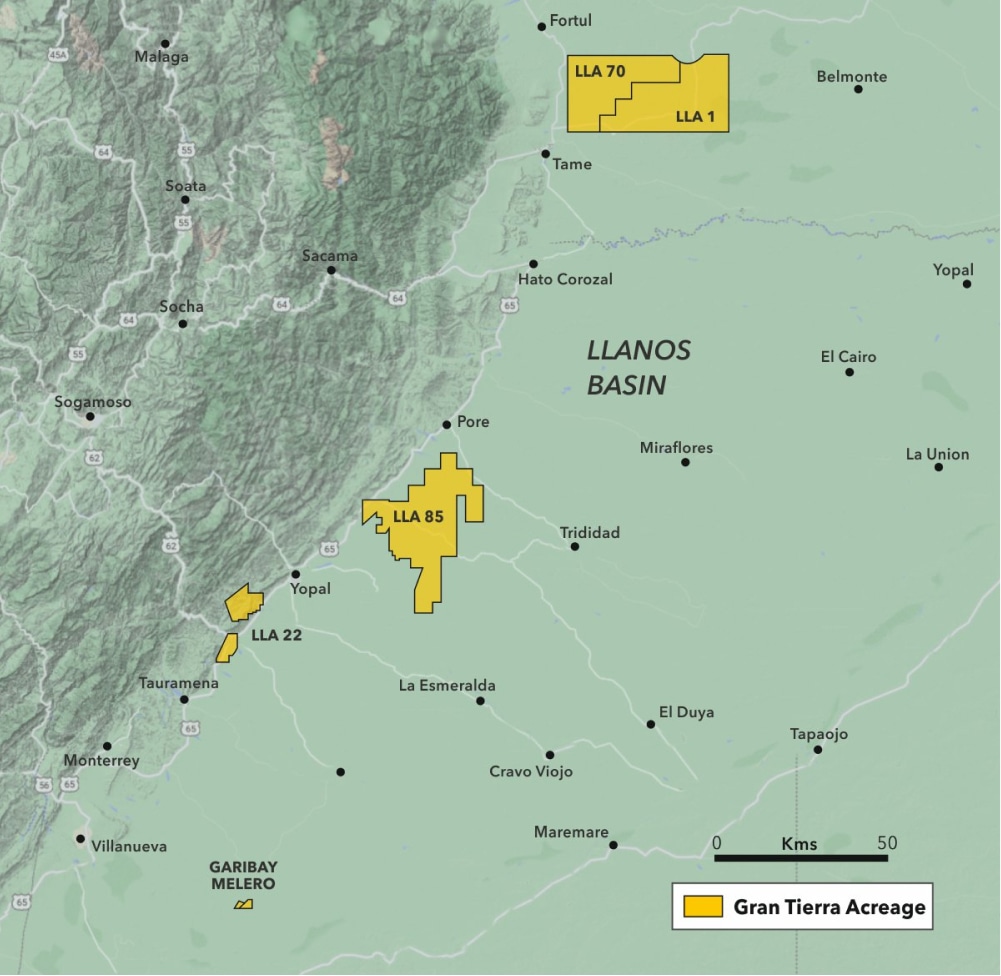

Llanos Acreage

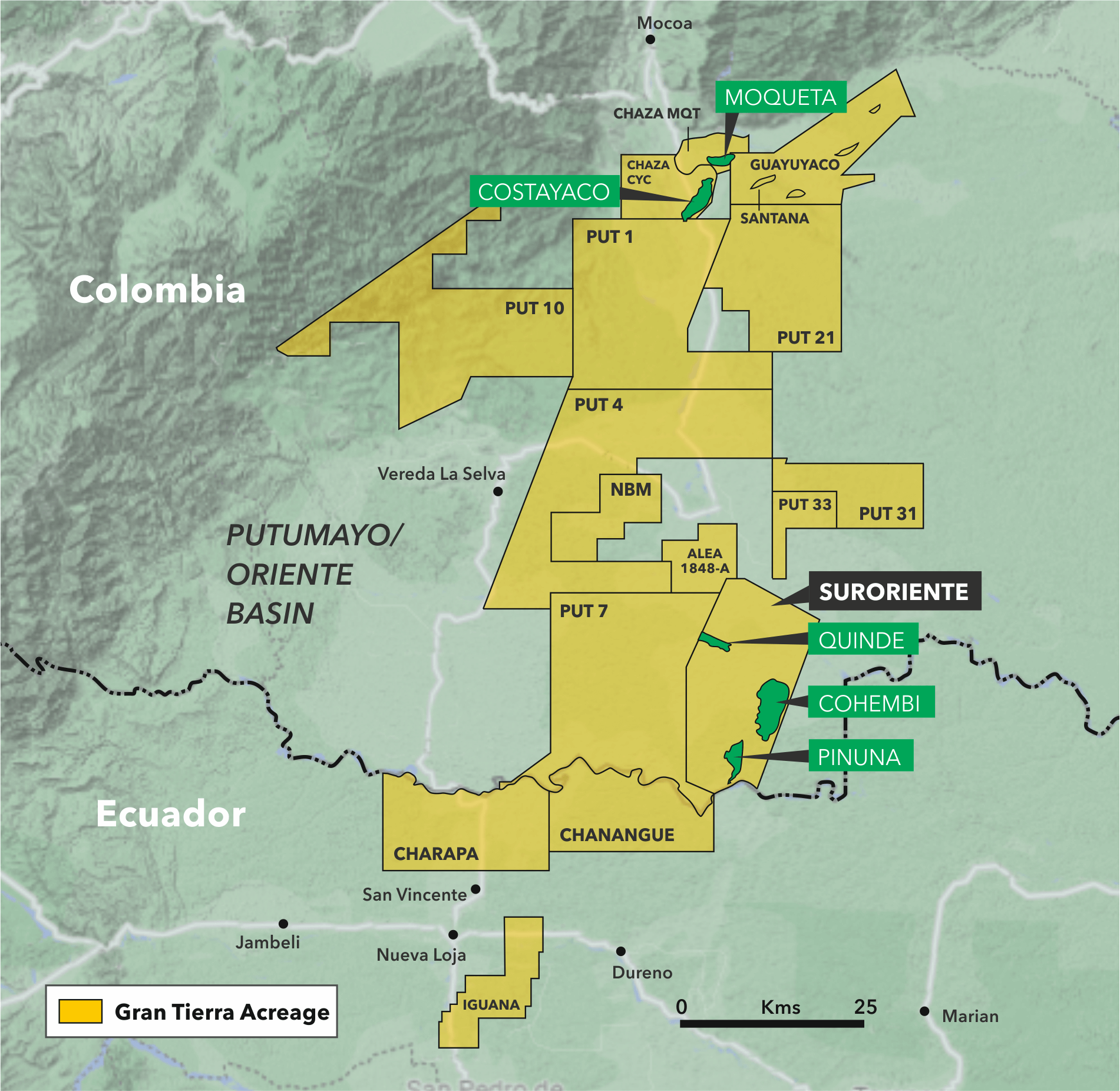

Putumayo & Ecuador Acreage

Zoom

- 2024 W.I RESERVES METRICS2

1P Reserves 2P Reserves 1P After-Tax NPV10 2P After-Tax NPV10 167 MMBOE (1) 293 MMBOE (1) US$1.4 billion (1) US$2.1 billion (1) 10 Years RLI (2) 17 Years RLI (3) $19.53 NAV per share (1)(3) $41.05 NAV per share (1)(3)

- GRAN TIERRA ASSETS UNDER WATERFLOOD

Gran Tierra utilizes waterflood technology as a secondary recovery method in Colombia. All four core assets in Colombia are under waterflood at different stages of maturity and they greatly exceed success factors as per Willhite’s waterflood screening criteria.4 Gran Tierra’s Colombian assets rank as world-class candidates for waterflooding. Factors Favourable for Waterflooding4 Acordionero Costayaco Moqueta Cohembi Initial Oil Saturation > 40% 78% 86% 78% 90% Oil-Zone Thickness > 15 ft 330 ft 114 ft 160 ft 125 ft Permeability (Average) > 10 mD 750 mD 225 mD 275 mD 2,500 mD Depth in Feet > 1,000 ft 8,000 ft 8,400 ft 3,150 ft 9,100 ft Viscosity < 15,000 cP 230 cP 1.5 cP 3.6 cP 28 cP

-

View Footnotes

-

1 Per Gran Tierra McDaniel Reserves Report with an effective date of December 31, 2024

2 Based on an annualized production figure based on November and December for Canada plus Colombia and Ecuador actual production, in each case, for the fourth quarter of 2024. The total production rate was 46,619 BOEPD

3 Based on December 31, 2024 share count of 35.97 MM shares, and an estimated 2024 year-end net debt of $682 MM comprised of Senior Notes of $787 MM (gross) less cash and cash equivalents of $104 MM

4 Willhite. Paul G. Waterflooding. SPE Textbook Series Volume 3. Society of Petroleum Engineers. Richardson, Texas. 1986, p. 112